Building Lives That Go Beyond

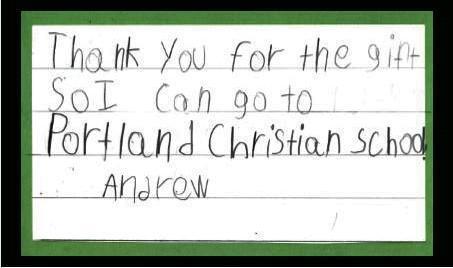

Your support allows many students to receive a quality Christian education that only a school like PCS can give.

Your contributions make a huge difference! For over 75 years, the prayers and generosity of those who believe in the importance of educating students with a Biblical worldview has built the foundation that impacts our students today. As a Christ-centered, college preparatory school with a global impact, we depend on the support of parents, grandparents, alumni, and friends to carry out our mission. We carefully steward your gifts by investing in what matters most—our people, programs, and facilities. When you give to Portland Christian Schools, you partner with us in shaping lives that extend far beyond PCS.

The PCS Annual Fund

Your gift to the PCS Annual Fund helps to bridge the gap that tuition alone does not cover. The Annual Fund supports school operations and financial aid, and thus blesses every single PCS student – from preschool to high school. You can see the work of the PCS Annual Fund in every aspect of student life:

- Student Financial Aid

- Facility improvements

- Curriculum implementation

- Technology enhancements

- Staff training

Portland Christian Schools accepts designated and undesignated gifts. If a program, project, or giving purpose becomes overfunded, your gift will be applied where needed most.

PCS is a registered non-profit organization under the IRS 501(c)3 requirement. Our taxpayer ID number is 93-0401248. We will send a receipt acknowledging your gift; it is advisable to keep this receipt for tax purposes.

Ways to Give

Immediate Gifts

- Give securely online with a credit card

- Mail a check to:

Portland Christian Schools

12425 NE San Rafael Street

Portland, OR 97230 - Call us at 503-256-3960 x206 with your credit card information

Employer Matching Gifts

Many employers match charitable gifts made by their employees. Check with your employer to see if your company has a program that could benefit PCS, or call us at 503.256.3960 x271.

DAF – Donor Advised Fund Gifts

Donor Advised Funds are a popular tool for tax-efficient charitable giving. To give from a DAF, log in to your account on your DAF sponsor’s website (e.g., Fidelity Charitable, Schwab Charitable, Vanguard Charitable), find the option to recommend a grant, then search for “Portland Christian Schools” or for our EIN: 93-0401248, and specify the amount you wish to give. The funds are sent directly to PCS.

QCD – Qualified Charitable Distributions

If you are 73 or older and have a traditional IRA, you can make a qualified charitable distribution directly from your IRA to Portland Christian Schools. This distribution can count towards your required minimum distribution (RMD) and is not included in your taxable income.

Stock and Noncash Gifts

We love receiving noncash gifts! If you would like to learn more about how to make a gift of stock or real estate, make a gift in kind, or make an estate gift, please call 503-256-3960 x206 or email our CFO, Jennifer Loffink at jennifer.loffink@pcschools.org. We are happy to walk you through the process.

Thank You for Your Generosity

Each year, hundreds of dedicated parents, grandparents, alumni, and business partners reach out to their peers and encourage them to support our school. Thank you in advance for giving to our school. Thank you for making this school a place of authenticity, where students grow in relationship with their Heavenly Father. Thank you for helping us fill all of our seats with students eager to learn about Jesus. Your gift equips our students to grow and succeed as they mature into tomorrow’s leaders. Thank you for making Kingdom impact!

PCS is a member of the Evangelical Council for Financial Accountability (ECFA) and has earned a Silver Seal of Transparency from Candid/GuideStar.